EN

- EN

- DE

[email protected]+466788483444

Poland

Ul. Okrzei 1A / 10P, Warsaw

The Republic of Kazakhstan

Astana, Almaty district, st. 101, bld. 49 B

London

Canterbury Court Kennington Park Business Centre London SW9 6DE

story behind

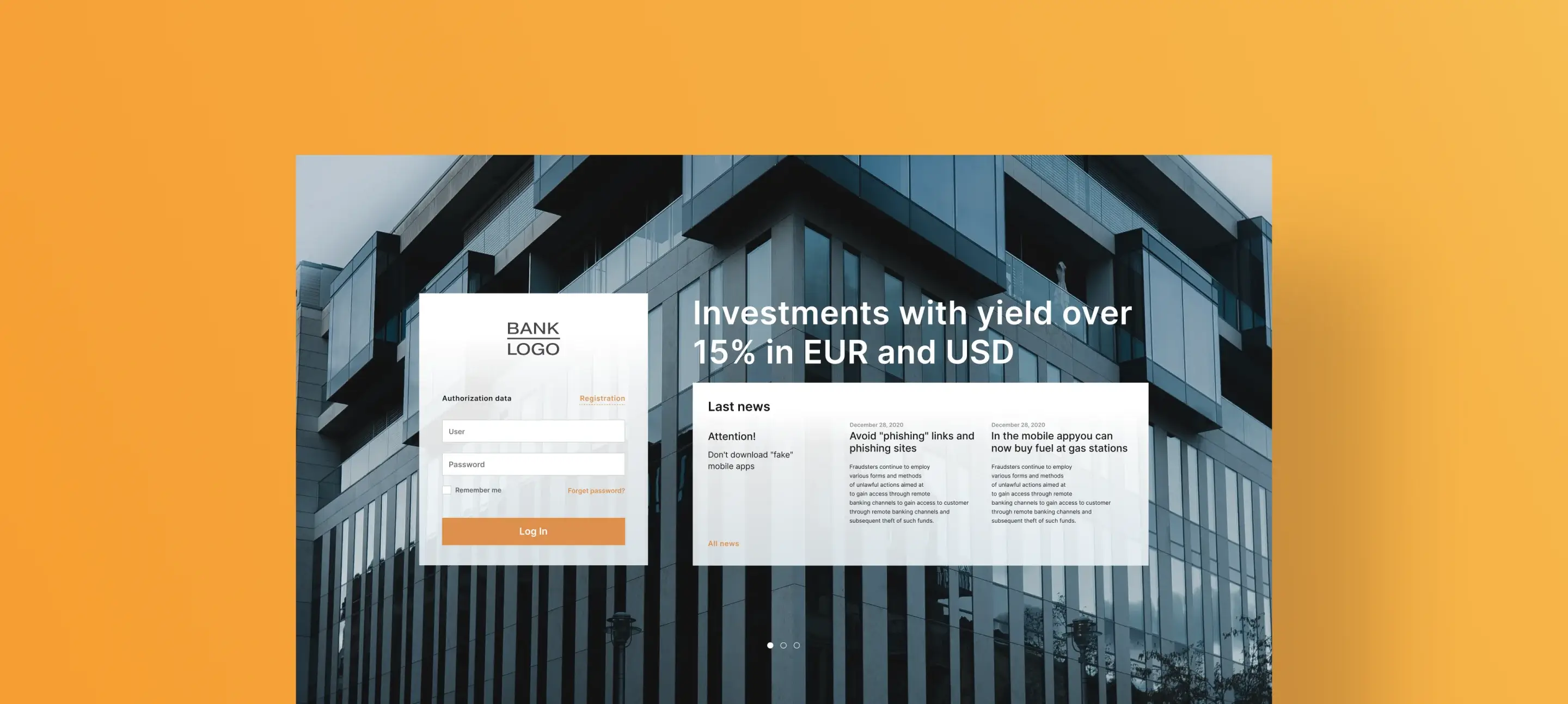

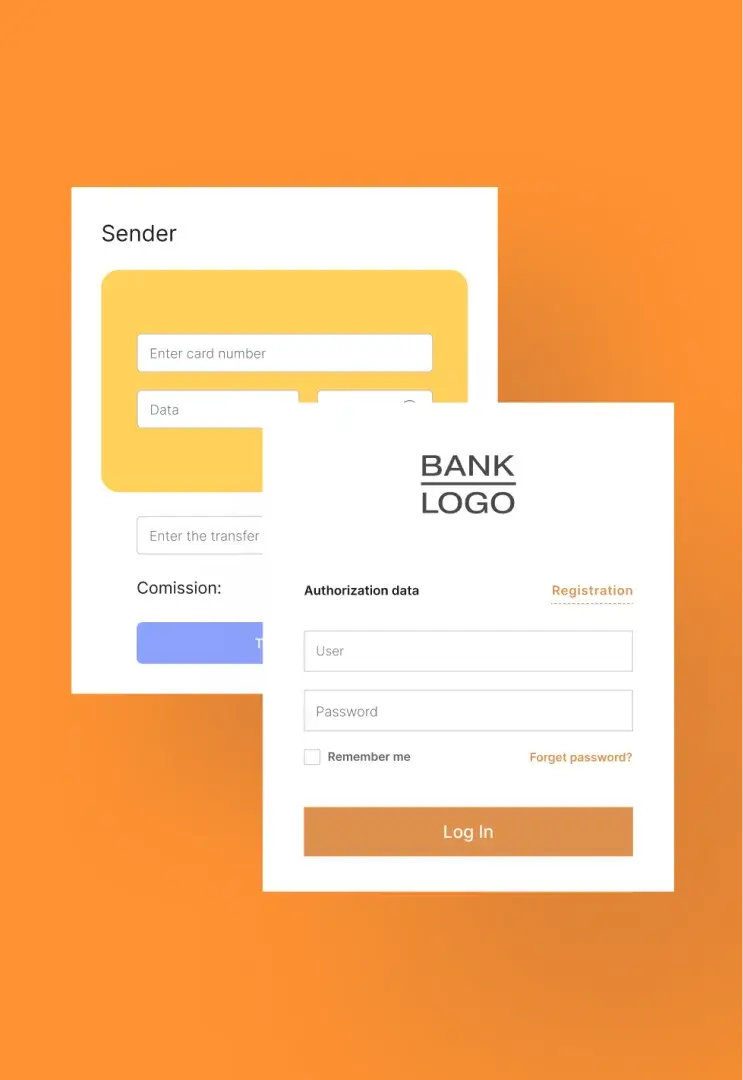

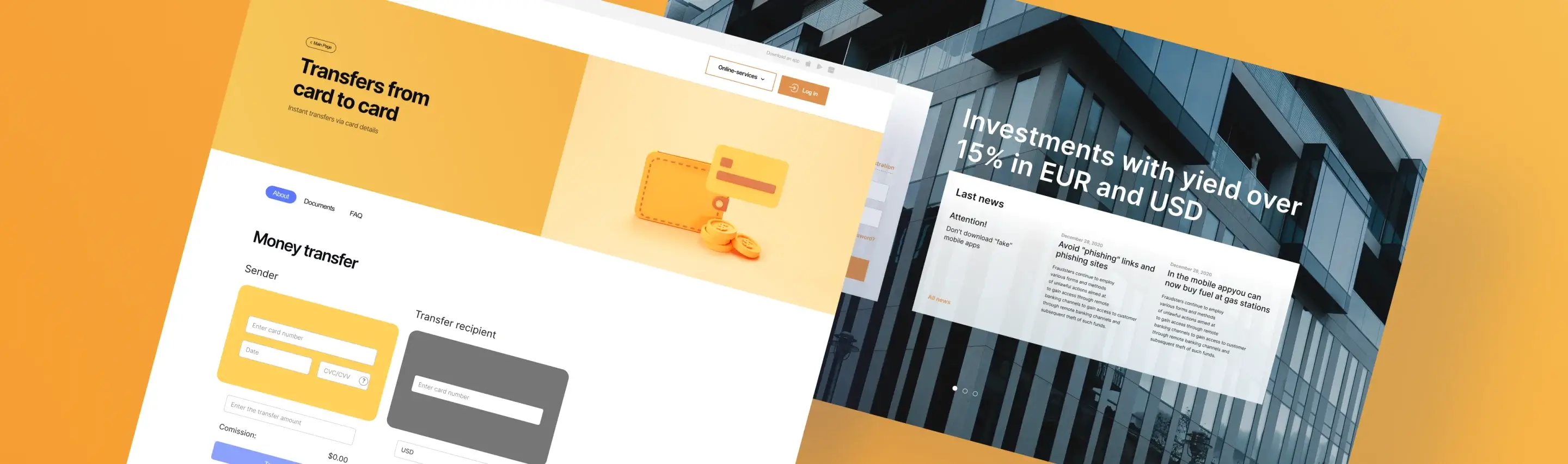

One of the largest corporate banks in Poland. Faced a difficult challenge — to update the outdated version of mobile banking app within 6 months. The old version could not provide an acceptable level of comfort when using mobile devices or an HD resolution monitor.

Our collaboration began with just a redesign, but it quickly evolved to encompass much more. Throughout the process, we not only updated the application's appearance but also enhanced its functionality significantly. In just 6 months it turned out to be an entirely new application that boasts optimal performance, an extensive range of features, and a sleek, appealing design. Yes, all in one simple and beautiful app.

Challenges & solutions

The existing visual design of the mobile banking app appeared outdated and lacked a modern and user-friendly interface, leading to potential user disengagement and dissatisfaction.

We used METRO design as a conceptual visual style. This concept is characterized by a clean, minimalist, and intuitive approach. By incorporating the METRO design principles, the user interface was transformed into a contemporary and user-friendly layout.

An important requirement for the bank was the website version for visually impaired people. It was necessary to develop a visual template that creates a contrast between the text and the interface elements.

We created a design for this version which is represented as white elements on a black background, or black elements on white. This allowed us to create two suitable versions of the interfaces. The system also has the ability to change the font size of the text for the convenience of users.

proccess

Agile methodology forms the cornerstone of our work philosophy. Through a seamless blend of innovative practices, including regular demos, comprehensive progress tracking, and a unique pay structure based on hours invested, we've constructed a workflow that ensures optimal outcomes and client satisfaction.

features

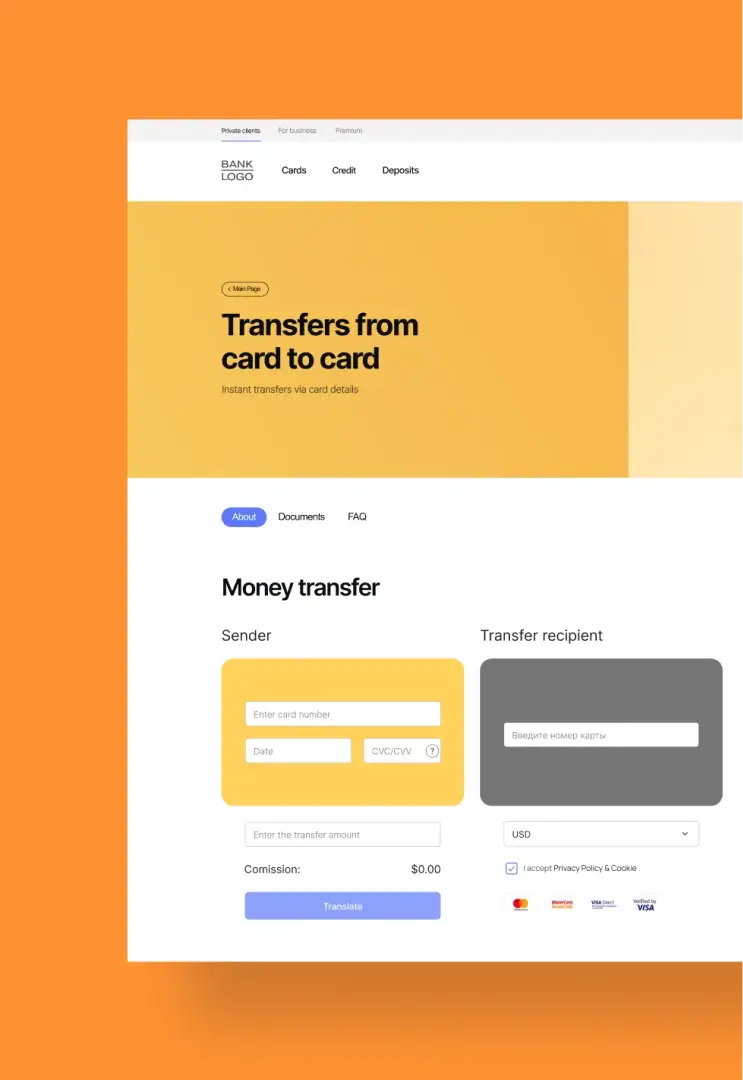

Users place an order in their personal account and receive a special code on their phone. At the ATM, they can enter this code to receive the cash.

The tool helps users track, manage, and optimize their finances. Payments are classified by class (groceries, restaurants, healthcare, etc.). The system can work with all users cards and currencies, taking into account both income and expenses completely.

To enhance security, we integrated biometric methods like fingerprint scanning and facial recognition for login and transaction verification.

We implemented in-app customer support via AI-powered chatbots that provide quick assistance to users, improving their overall experience.

project team

As a result, it took us only 6 months to deliver a new version of the internet banking web app with an improved UI/UX and a broader set of digital banking services. Among the new features there are personal financial manager, bank deposits calculator and others. We continue to successfully work with the bank in terms of support, maintenance and updates implementation.

Looks like your business could benefit from a similar service? Let’s discuss how we can help you reach your business goals!

Plavno experts contact you within 24h

Submit a comprehensive project proposal with estimates, timelines, team composition, etc

Discuss your project details

We can sign NDA for complete secrecy

Vitaly Kovalev

Sales Manager