EN

- EN

- DE

[email protected]+466788483444

Poland

Ul. Okrzei 1A / 10P, Warsaw

The Republic of Kazakhstan

Astana, Almaty district, st. 101, bld. 49 B

London

Canterbury Court Kennington Park Business Centre London SW9 6DE

story behind

Our clients are a group of seasoned financial consultants, and have spent years advising clients on how to manage their finances. Over the years, they noticed a common thread among many of their clients – a lack of basic financial literacy. Clients often struggled to understand concepts like budgeting, investing, and debt management, leading to poor financial decisions and, at times, financial hardship. Frustrated by this issue, our clients decided to take matters into their own hands and make a positive change. They envisioned an educational platform that would demystify financial topics, providing accessible and engaging resources for individuals of all backgrounds. Realizing they lacked the technical expertise to bring this vision to life, it was decided to turn to Plavno for our expertise in building educational apps.

Challenges & solutions

As the platform is full of gamification elements, ensuring that it functions well on various web browsers and operating systems presents a significant development challenge.

Plavno development team employed a cross-browser testing strategy and compatibility checks during the development process. They identified and addressed issues arising from differences in browser rendering and operating system behavior.

Striking the right balance between gamification elements to motivate users without detracting from the seriousness of financial education.

To address this challenge, Plavno designers and developers worked in especially close cooperation with the clients as they are financial consultants, and even conducted user surveys and feedback analysis, keeping a close eye on the impact of gamification elements on the learning experience.

proccess

Agile methodology forms the cornerstone of our work philosophy. Through a seamless blend of innovative practices, including regular demos, comprehensive progress tracking, and a unique pay structure based on hours invested, we've constructed a workflow that ensures optimal outcomes and client satisfaction.

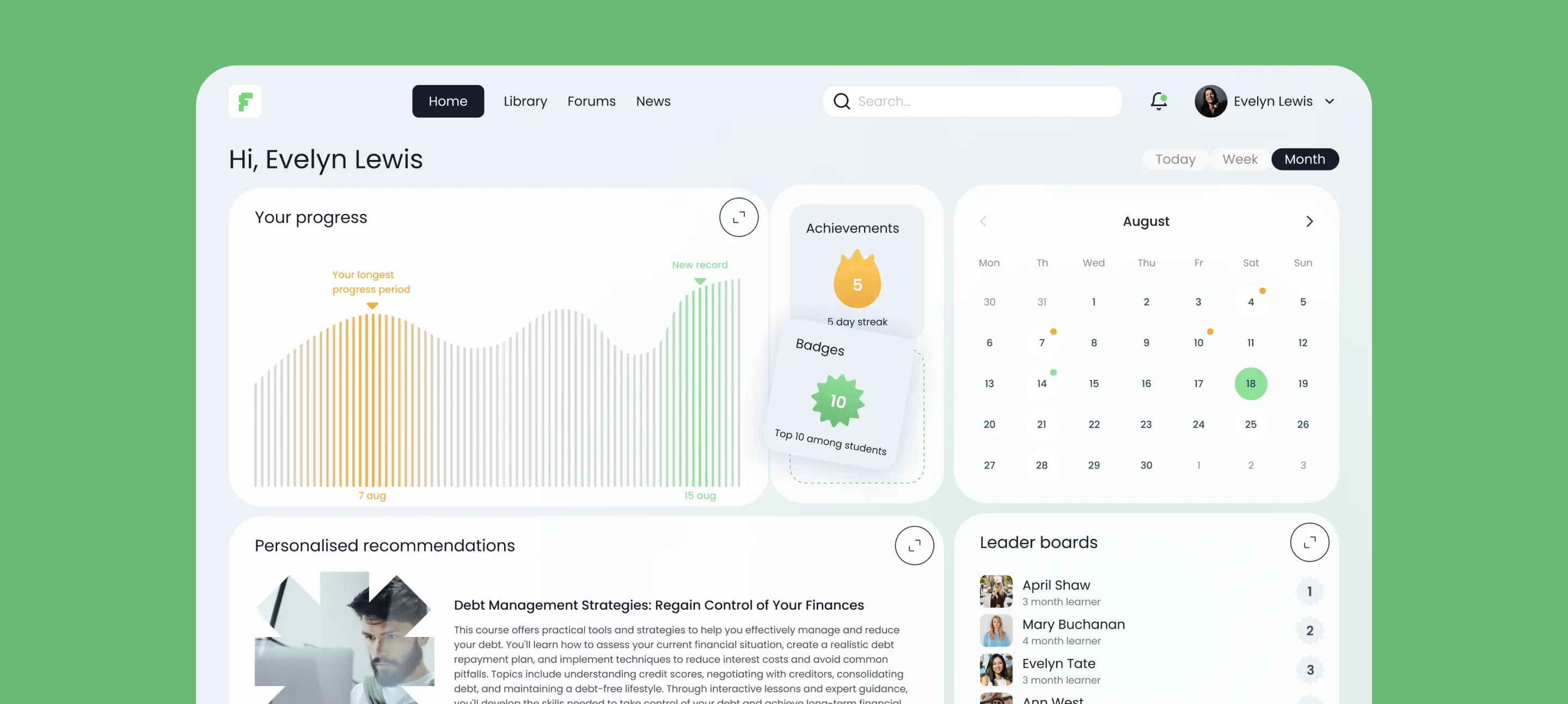

features

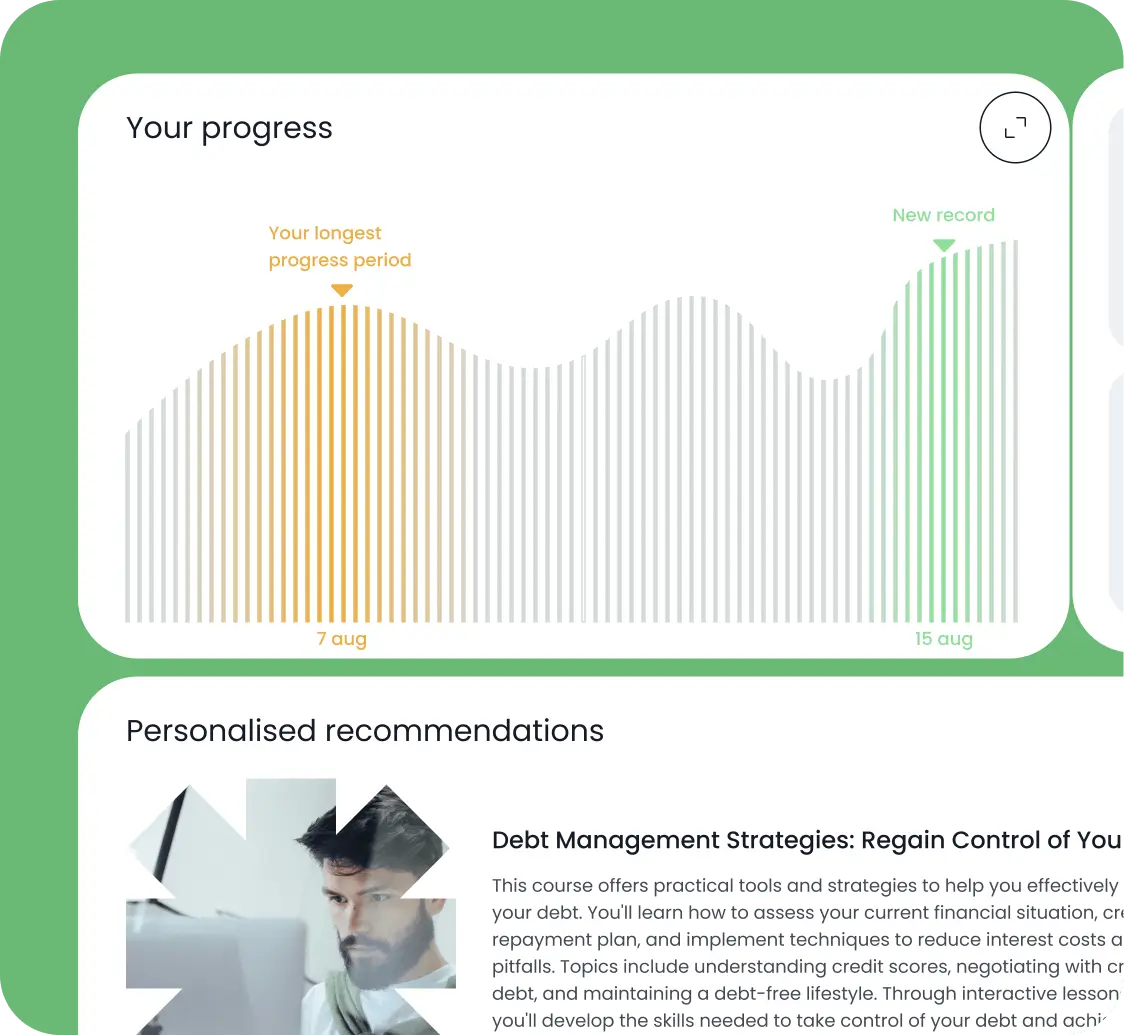

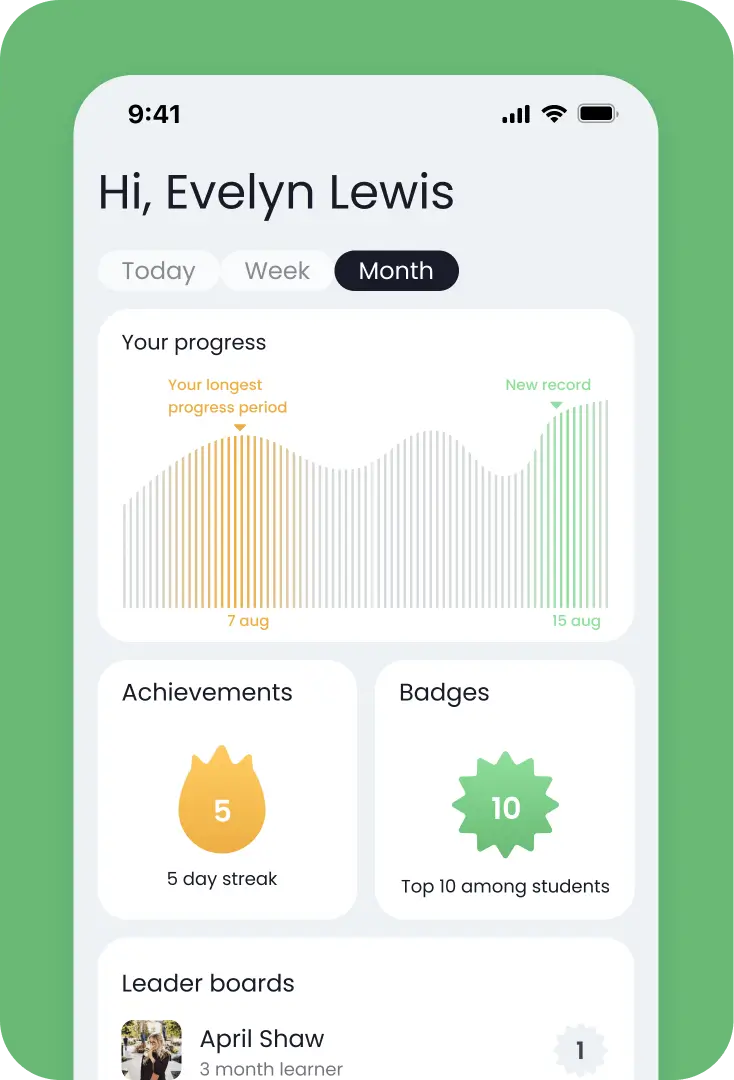

Engaging, bite-sized lessons covering various financial topics, from budgeting to investing, designed to cater to different learning styles. Lessons can include multimedia elements like videos, infographics, and interactive calculators for enhanced comprehension.

Regular quizzes to reinforce learning, with immediate feedback to track progress and understanding. Adaptive quizzes adjust difficulty based on user performance, ensuring a personalized learning experience.

Realistic financial scenarios and simulations allowing users to practice making financial decisions in a safe environment. Simulations can range from simple budgeting exercises to complex investment portfolio management, providing hands-on experience.

Customized learning journeys based on user preferences and skill levels. Machine learning algorithms analyze user interactions and recommend tailored content and exercises to address specific areas of improvement.

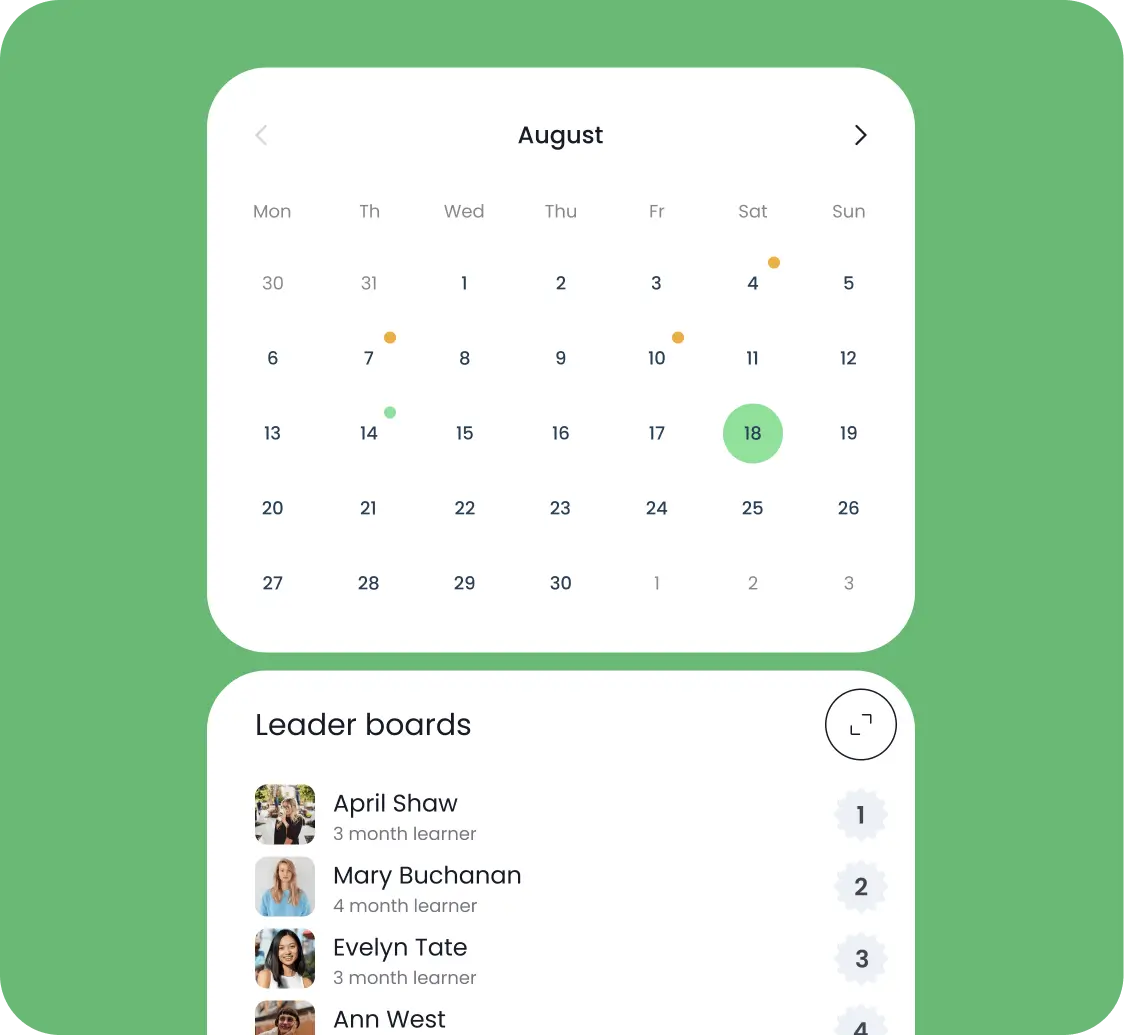

Robust progress tracking and reporting tools that enable users to monitor their financial education journey. Users can view their performance history, set goals, and receive insights on areas requiring additional focus.

A suite of financial calculators to assist users in making practical financial calculations, such as loan amortization, retirement planning, and investment returns.

project team

The final product turned out to be as useful as possible for the business of our customers. They have successfully implemented it into their consulting business, which has obviously become a competitive advantage. End users consistently provided positive feedback on the platform's user-friendliness and effectiveness in improving their financial literacy.

Looks like your business could benefit from a similar service? Let’s discuss how we can help you reach your business goals!

Plavno experts contact you within 24h

Submit a comprehensive project proposal with estimates, timelines, team composition, etc

Discuss your project details

We can sign NDA for complete secrecy

Vitaly Kovalev

Sales Manager